Gas storage levels in Europe are well below their five-year average but not markedly below their previous five-year lows, which were reached in 2017.īased on the available information, Russia is fulfilling its long-term contracts with European counterparts – but its exports to Europe are down from their 2019 level. Going forward, the European gas market could well face further stress tests from unplanned outages and sharp cold spells, especially if they occur late in the winter.

“Recent increases in global natural gas prices are the result of multiple factors, and it is inaccurate and misleading to lay the responsibility at the door of the clean energy transition,” said IEA Executive Director Fatih Birol.

#Natural gas prices market watch november 2015 series

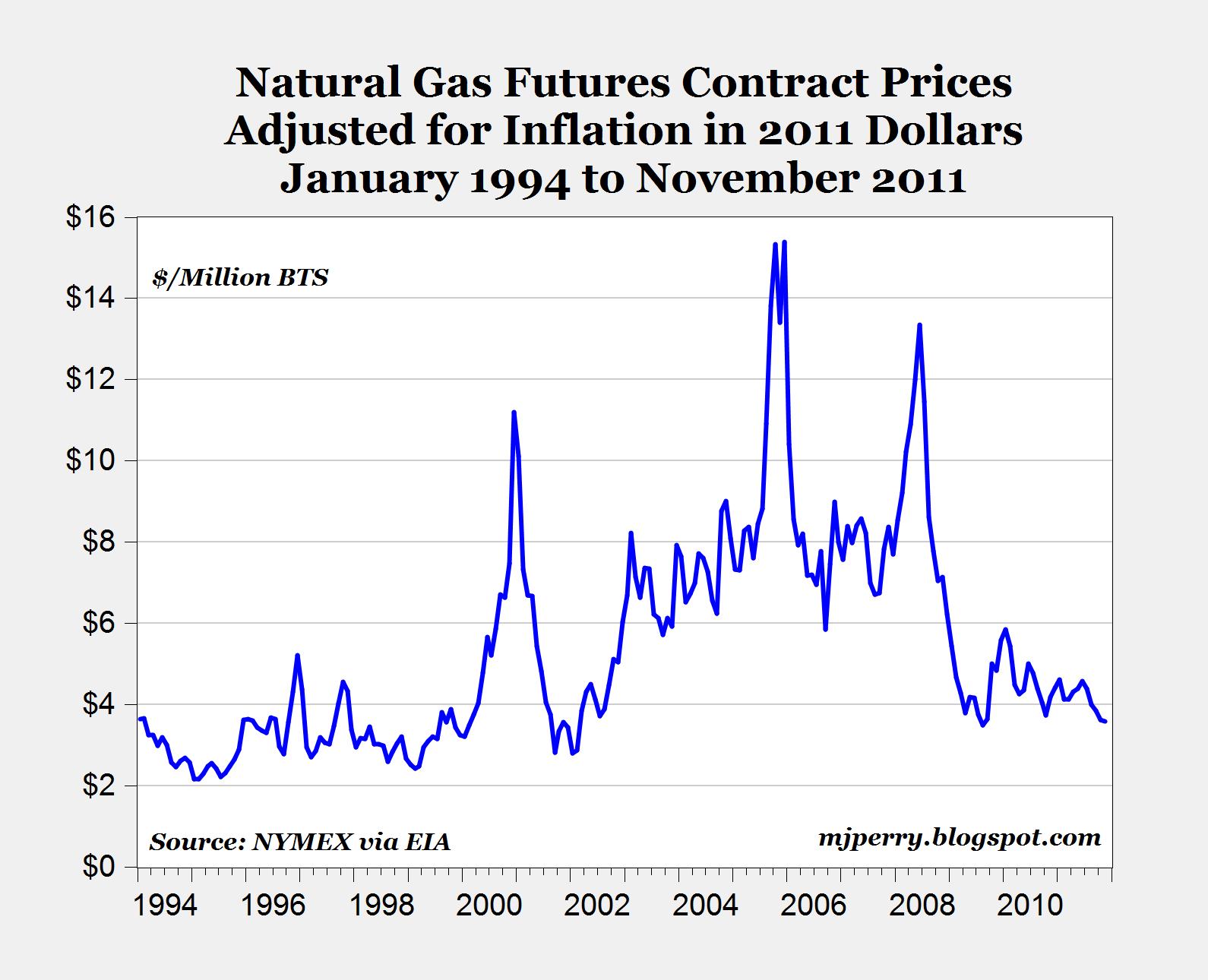

On the supply side, liquefied natural gas (LNG) production worldwide has been lower than expected due to a series of unplanned outages and delays across the globe and delayed maintenance from 2020. In Asia, gas demand has remained strong throughout the year, primarily driven by China, but also by Japan and Korea. All of these developments added to the upward trend in gas demand. They were followed by heatwaves in Asia and drought in various regions, including Brazil. There were strong cold spells in East Asia and North America in the first quarter of 2021. These include a particularly cold and long heating season in Europe last winter, and lower-than-usual availability of wind energy in recent weeks.Įuropean prices also reflect broader global gas market dynamics. We forecast that natural gas prices will fall in early 2023 because of more domestic natural gas production, less LNG export and domestic natural gas demand growth, and more natural gas placed in storage.The steep rise in European gas prices has been driven by a combination of a strong recovery in demand and tighter-than-expected supply, as well as several weather-related factors. We expect that natural gas storage levels will be 9% below the five-year average at the end of October, the beginning of this coming heating season. Natural gas inventories started the 2022 summer injection season (April through October) 17% below the five-year (2017–21) average. We expect dry natural gas production will average 96.5 Bcf/d in 2022, which is 3.2% (or 3.0 Bcf/d) higher than the 2021 average.īecause demand for natural gas has outpaced production, natural gas inventories have remained low. production of dry natural gas to increase in 2022, but not as much as demand. High international natural gas prices may also lead to more U.S. LNG cargos have gone to Europe, compared with 34% in 2021. exports of liquefied natural gas (LNG) will remain high during this summer, partly as a result of Russia’s full-scale invasion of Ukraine. However, this fuel substitution has been relatively limited in recent months because of supply constraints in the coal market and historically low coal stockpiles.

electric power sector, power plants have tended to consume more coal as natural gas prices increase. electric power sector will average 0.9 billion cubic feet per day (Bcf/d) more in 2022 than in 2021, even though we expect the Henry Hub price to be $3.49/MMBtu higher. We expect that consumption of natural gas in the U.S. electric power sector has remained high despite high natural gas prices.

natural gas prices to remain relatively high in 2022 because of lower-than-average natural gas inventories resulting from factors affecting both supply and demand.Ĭonsumption of natural gas in the U.S. Henry Hub benchmark in Louisiana averaged $8.14 per million British thermal units (MMBtu) in May 2022, and we expect the Henry Hub price to average $8.71/MMBtu this summer (June through August). natural gas spot prices will increase again this month and then remain high through the rest of 2022. In our June 2022 Short-Term Energy Outlook (STEO), we forecast that U.S. Energy Information Administration, Short-Term Energy Outlook (STEO)

0 kommentar(er)

0 kommentar(er)